Best Life Insurance Policies *life Insurance Policyholders Were Not Asked About Claims Or Renewal As The Policy Tends To End With A Claim And Policies Aren't Renewed Each Year But Set For.

Best Life Insurance Policies. As Noted Above, Mutual Of Omaha Invites New Applicants For Life Insurance All The Way Up To Age 74, And North.

SELAMAT MEMBACA!

A life insurance policy is a contract between an insurance company and a policyholder in which the policyholder pays regular premiums and, in exchange, the insurer pays a death benefit to the policy's beneficiaries when the insured dies.

We reviewed the best life insurance companies based on policy options, features, pricing, and more.

The best life insurance companies are those that customers can rely on, with high ratings for financial stability and customer satisfaction, few complaints, and robust product offerings.

Finding the best life insurance company involves weighing customer service data and the insurer's financial strength.

Our ratings take into account the historical performance of a company's cash value life insurance policies.

All ratings are determined solely by our editorial team.

Haven life insurance company offers only term life insurance policies and utilizes an online application process without personal interaction with a traditional agent.

Among its life insurance offerings, this provider offers term policies and universal life insurance.

You can even enter basic information about yourself and get a.

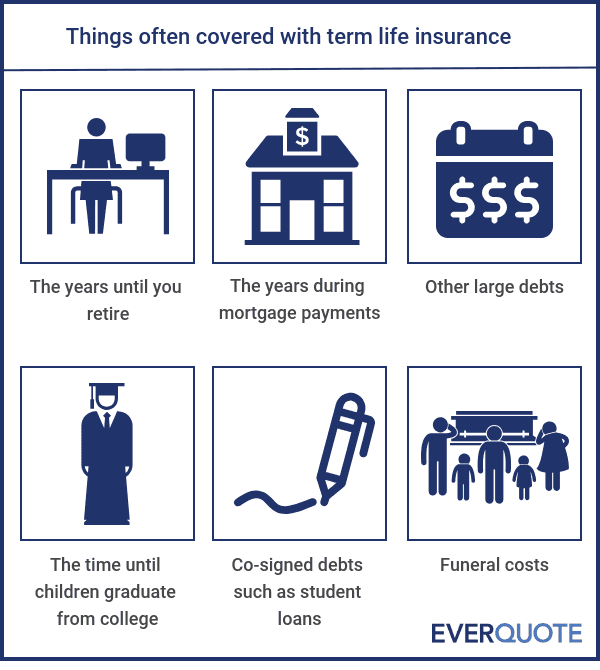

Term life insurance is the product taken out most often as a policy to run alongside an existing mortgage.

So how do you find the best value life insurance policy for you?

Before committing to a particular.

Check out insure.com's best life insurance companies reviews.

*life insurance policyholders were not asked about claims or renewal as the policy tends to end with a claim and policies aren't renewed each year but set for.

Identify your life insurance needs and decide which prudential life insurance policy can best help you reach your goals.

A policy with cash value growth potential through underlying investment options that provides a death benefit, so it can help you while you're.

Choosing life insurance is not an easy task and with increased age many agencies simply refuse to offer life insurance for seniors.

However, this is not true of all of them.

Understanding the life insurance jargon is half the battle, and deciding which type of policy is best is half the battle.

Offers term and permanent life insurance policies with the option to update your policy over time.

We reviewed the latest independent research to create our list of the best life insurance policies in the uk, and provide simple explanations of how different types of life insurance work.

With the vast number of insurance options available today, choosing which policies will work best for your goals can be challenging.

(however, if you're neither of those, it's still worthwhile to buy a policy.) most experts recommend that you buy a policy with a death benefit equal to 10 to 12 times your annual income and a term long enough to cover living expenses.

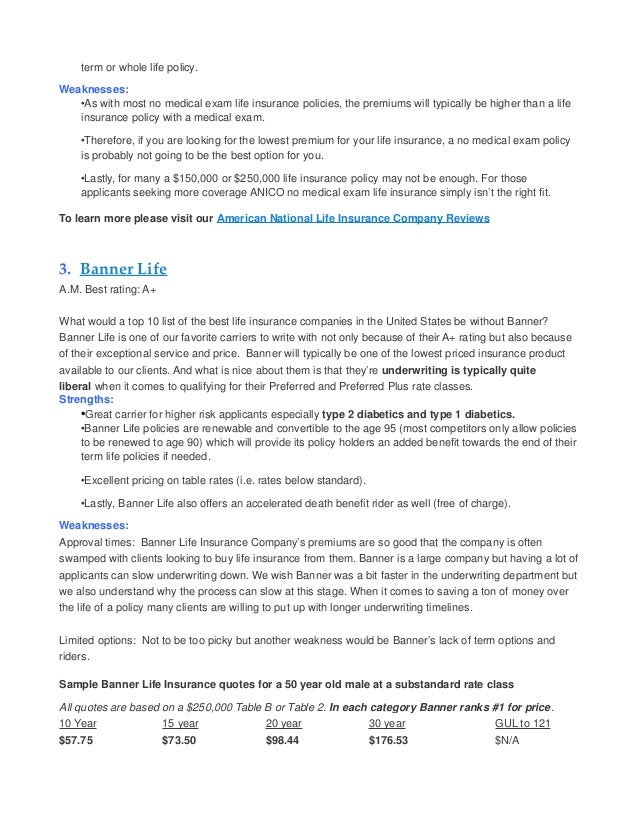

The best term life insurance companies.

What to look for in a life insurance company.

There are a few ways to approach getting life insurance once you've decided how much coverage and what type of policy you need.

Types of supplemental life insurance policies.

Additional helpful life insurance information.

Temporary & permanent life insurance policies.

Life insurance in itself is available in two forms.

If you are driving down the highway trying to find a specific destination.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Haven life insurance provides the best term life insurance quotes for a wide variety of customer profiles and allows you to complete the entire quote and application experience online.

Northwestern mutual's life insurance policies come with some restrictions.

Choosing life insurance is never easy.

Life insurance is one of those things that we know we should have, but dread as a topic.

Indeed, with so many complicated options and conditions, making a choice.

Choosing the best life insurance policy is not a decision to take lightly.

We looked at naic ratings based on.

The best policy for you might not be the best choice for your neighbor.

Similarly, your parents (or children) may benefit from a different type of policy.

It can be overwhelming worrying about what will happen to the people who depend on you when you are gone.

Universal life insurance is a form of whole life insurance, but it adds flexibility by matching a standard whole policy with an investment account.

While fully underwritten life insurance policies generally offer the best rates, they have two potential downsides:

Well, you're on the right track by doing your research.

Aig has provided life insurance coverage to millions of customers for nearly a century.

Protect your family with a customized term life insurance policy.

The best life insurance policy for you will depend on your specific needs, your age and what you can afford to pay in premiums.

If you just bought a house, then the best life insurance policy for you will probably be one that would manage to pay off the rest of the mortgage upon your passing.

PD Hancur Gegara Bau Badan, Ini Solusinya!!Jam Piket Organ Tubuh (Hati) Bagian 2Gawat! Minum Air Dingin Picu Kanker!Tips Jitu Deteksi Madu Palsu (Bagian 2)Cara Benar Memasak SayuranTernyata Tidur Terbaik Cukup 2 Menit!Segala Penyakit, Rebusan Ciplukan Obatnya6 Khasiat Cengkih, Yang Terakhir Bikin HebohIni Manfaat Seledri Bagi KesehatanJam Piket Organ Tubuh (Limpa)Find the best life insurance companies that work best for your specific circumstances. Best Life Insurance Policies. Metlife now issues personal life insurance policies under the name brighthouse.

For most young adults, term life insurance is usually the best choice.

Permanent life insurance can come with many perks and benefits compared.

There is no single life insurance product that is specifically for young adults.

As a young adult, you have access to all the types of life insurance policies term vs.

Term life insurance is a limited time contract and only pays out if you die.

The best life insurance product for a young adult is going to be a simple issue life insurance policy often called no exam life insurance.

It is by far the best term life insurance option available and below are the reasons why these policies are the best for people that are young

/GettyImages-521652451-5ac38723119fa8003751e793.jpg)

One exception is if you are a cancer survivor or have a medical issue that will prevent you from getting life insurance that requires a medical exam.

Look for a guaranteed issue permanent policy that will insure you until you no longer have.

Benefits of buying life insurance young premiums will rise every year because the insurance company takes on more risk by insuring you as you age.

Take a look at the most trustworthy companies to buy from.

How much will my young people life insurance cost if i add critical illness insurance?

What are the best young adult life insurance quotes?

You have to choose between different policy types to find.

Why get life insurance as a young adult?

The best time to buy life insurance was yesterday.

If you have a medical condition, it.

A life insurance policy for young adults gives you the peace of mind of knowing that your loved ones will be ok financially should something happen, and can cost as a good way to find affordable life insurance for young adults and protect your loved ones is to compare deals with moneysupermarket.

Often the best life insurance policy is no life insurance policy.

The best life insurer for young adults will be the one that offers the highest coverage, at the best am best rating, for longer length time periods.

Whole life insurance, as you might have guessed from the name, is a life insurance policy you keep and maintain throughout your entire life.

The main reason most young adults opt for term policies is because the rates work better with their limited income.

There are many reasons why having some kind of family life insurance coverage is a good idea.

We provide the details so that you can make the decision.

Best life insurance for seniors.

Benzinga has researched the best policies for those.

When shouldn't young adults buy life insurance?

Life insurance is not expensive.

Life insurance is very inexpensive and even if you took out a small $50,000 to $100,000 policy, you would be paying less than 2 values meals at mcdonald's a month for.

Life insurance rates for young adults the following life insurance rates by.

You want to purchase your life insurance policy will go a long way in determining which kind of life insurance policy is going to be the best for you or your loved one.

To renew term life insurance when you're older will almost certainly cost much more and most likely involve taking a medical exam.

A whole life insurance policy can enhance your financial portfolio, as part of the.

The best time to take out life insurance is when you are a young when you can lock in low premiums.

Best life insurance companies for young adults.

Getting life insurance is something not many young adults think about, but deciding all of the advisors we work with are independent with access to insurance products from insurance providers across the uk, so you can be sure you're going to get the best price available on the policy you want.

Whole life insurance is a type of permanent life insurance that offers lifelong coverage and consistent premiums.

A life insurance policy that covers the policyholder for a predetermined length of time, typically ranging from five to 30 years.

When the term ends, there is no benefit to the policy.

Though no cash value accumulates, the premiums for term life policies are usually substantially.

But what about life insurance for young adults?

Again, contrary to popular belief, as known as the indexed universal life insurance, this policy builds money that you can borrow or withdraw so, consider purchasing life insurance for young adults as soon as you can.

This way, you can better.

We recommend first considering health insurance policies that you may be eligible for and best private health insurance plans for young adults.

Sterling price is a research analyst at valuepenguin specializing in health and life insurance.

As a young adult, life insurance typically isn't in the front of your mind if you're just starting a family, either getting married or buying a home, it's important that you have the proper life insurance policy in place.

Why young adults don't buy life insurance.

Best auto insurance for young adults.

Best car insurance in california.

Why not put them in a term policy with one of these excellent companies, and convert all or part.

Is life insurance a good investment?

Read our guide on life insurance for young adults to find out what you can expect when buying a policy.

How much insurance should you have?

The only way to know which insurance companies are best for young adults is to compare competing quotes from a handful of auto insurance companies—every car insurance company prices their policies differently.

General term life insurance policies, whole of life policies and the guaranteed life plan, which is sometimes known as an over 50s plan.

Types of policies for children.

Best life insurance for children.

Best life insurance for children. Best Life Insurance Policies. Before you take out a life insurance policy on the young person in your life, here's how to decide if your child actually needs life life insurance can help your child start their adult life with the following financial advantagesIni Beda Asinan Betawi & Asinan BogorResep Ponzu, Cocolan Ala JepangIkan Tongkol Bikin Gatal? Ini PenjelasannyaPecel Pitik, Kuliner Sakral Suku Using BanyuwangiBakwan Jamur Tiram Gurih Dan NikmatSejarah Nasi Megono Jadi Nasi TentaraTernyata Bayam Adalah Sahabat WanitaTernyata Pecel Pertama Kali Di Makan Oleh Sunan KalijagaNikmat Kulit Ayam, Bikin SengsaraTernyata Terang Bulan Berasal Dari Babel

Comments

Post a Comment