Best Life Insurance Policies A Life Insurance Policy Is A Contract Between An Insurance Company And A Policyholder In Which The Policyholder Pays Regular Premiums And, In Exchange, The Insurer Pays A Death Benefit To The Policy's Beneficiaries When The Insured Dies.

Best Life Insurance Policies. The Best Time To Buy Life Insurance Is When You're Young And Healthy.

SELAMAT MEMBACA!

A life insurance policy is a contract between an insurance company and a policyholder in which the policyholder pays regular premiums and, in exchange, the insurer pays a death benefit to the policy's beneficiaries when the insured dies.

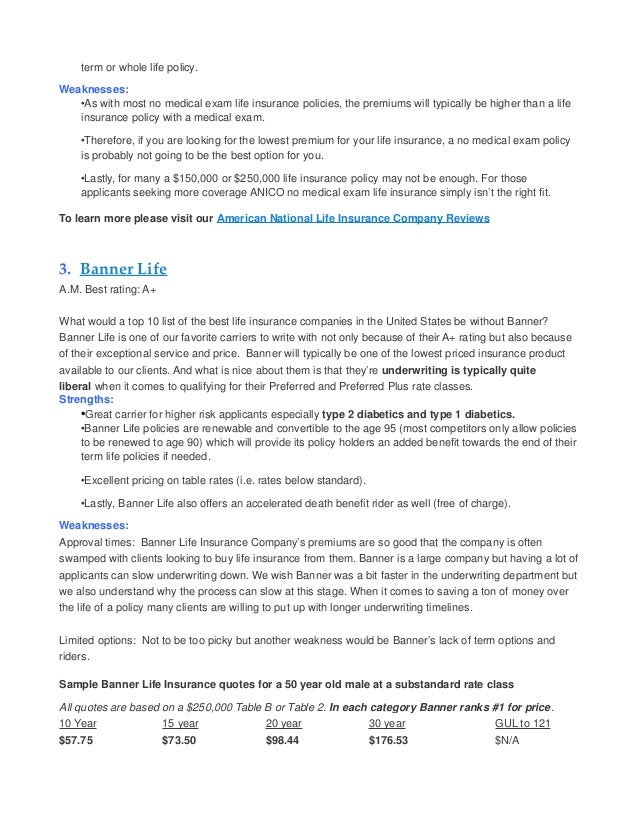

We reviewed the best life insurance companies based on policy options, features, pricing, and more.

The best life insurance companies are those that customers can rely on, with high ratings for financial stability and customer satisfaction, few complaints, and robust product offerings.

Finding the best life insurance company can mean navigating a bewildering range of product features and pricing variables.

All ratings are determined solely by our editorial team.

Haven life insurance company offers only term life insurance policies and utilizes an online application process without personal interaction with a traditional agent.

Finding the best life insurance company involves weighing customer service data and the insurer's financial strength.

See the individual company page to see how they performed with members.

*life insurance policyholders were not asked about claims or renewal as the policy tends to end with a claim and policies aren't renewed each year but set for.

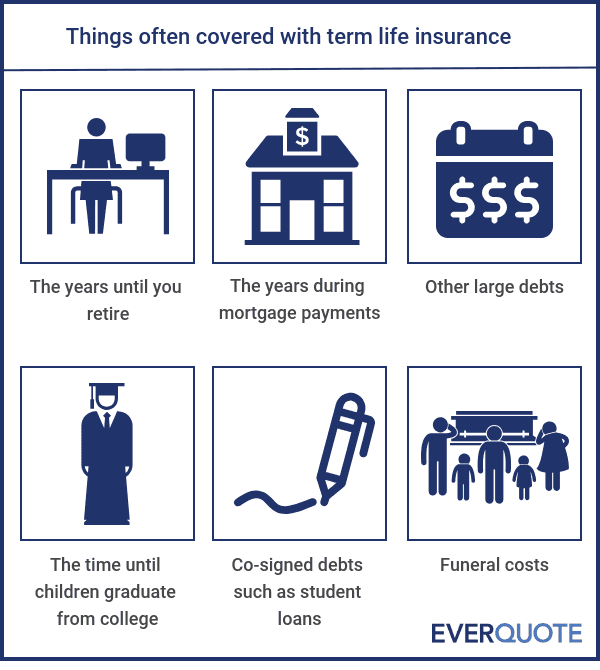

Term life insurance is the product taken out most often as a policy to run alongside an existing mortgage.

The best life insurance companies below offer superior products and customer service, and they exhibit financial strength and stability.

Among its life insurance offerings, this provider offers term policies and universal life insurance.

You can even enter basic information about yourself and get a.

Identify your life insurance needs and decide which prudential life insurance policy can best help you reach your goals.

A policy with cash value growth potential through underlying investment options that provides a death benefit, so it can help you while you're.

Research types of life insurance policies, provider coverage options and compare the best life insurance companies using hundreds of customer reviews.

Types of supplemental life insurance policies.

Additional helpful life insurance information.

What's the best type of life insurance policy for you?

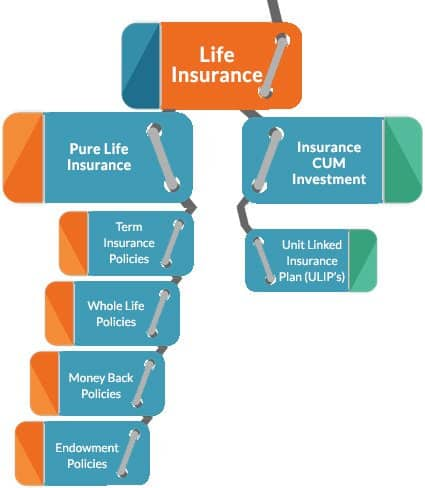

Life insurance in itself is available in two forms.

The best time to buy life insurance is when you're young and healthy.

(however, if you're neither of those, it's still worthwhile to buy a policy.) most experts recommend that you buy a policy with a death benefit equal to 10 to 12 times your annual income and a term long enough to cover living expenses.

What to look for in a life insurance company.

How we determined the winners.

There are a few ways to approach getting life insurance once you've decided how much coverage and what type of policy you need.

With the vast number of insurance options available today, choosing which policies will work best for your goals can be challenging.

Best for credit insurance options:

That's where credit life insurance comes in.

It will pay off your outstanding debts when you pass away.

If you are driving down the highway trying to find a specific destination.

The life insurance companies can offer you the best life insurance policy at the lowest rates possible.

Learn more about what kind of life insurance policies might be best for you as you age in place.

Life insurance is one of those things that we know we should have, but dread as a topic.

Indeed, with so many complicated options and conditions, making a choice.

The insurance company's history, as well as its reputation for customer service, financial stability and pricing, are just a few of the things that can impact both your experience and policy value.

We looked at naic ratings based on.

Aig has provided life insurance coverage to millions of customers for nearly a century.

It can be overwhelming worrying about what will happen to the people who depend on you when you are gone.

Universal life insurance is a form of whole life insurance, but it adds flexibility by matching a standard whole policy with an investment account.

Haven life insurance provides the best term life insurance quotes for a wide variety of customer profiles and allows you to complete the entire quote and application experience online.

Find the best life insurance companies that work best for your specific circumstances.

Metlife now issues personal life insurance policies under the name brighthouse.

As noted above, mutual of omaha invites new applicants for life insurance all the way up to age 74, and north.

A slower application process as you schedule, take, and await results how do you know what the best life insurance policy for you is?

Well, you're on the right track by doing your research.

But pacific life stands out for having plenty of life insurance policy options

This article, as well as others on this site, can help get you the information you need to make a smart and educated decision about which.

The best life insurance policy for you will depend on your specific needs, your age and what you can afford to pay in premiums.

Ini Cara Benar Hapus Noda Bekas Jerawat7 Makanan Sebabkan SembelitFakta Salah Kafein Kopi5 Manfaat Posisi Viparita KaraniTernyata Ini Beda Basil Dan Kemangi!!5 Olahan Jahe Bikin SehatIni Cara Benar Cegah HipersomniaAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`5 Khasiat Buah Tin, Sudah Teruji Klinis!!Gawat! Minum Air Dingin Picu Kanker!The best life insurance policy for you will depend on your specific needs, your age and what you can afford to pay in premiums. Best Life Insurance Policies. If you just bought a house, then the best life insurance policy for you will probably be one that would manage to pay off the rest of the mortgage upon your passing.

Although term plans are offered both online as well as offline.

Choose 1 crore life cover at rs.

16 a day and avail tax benefits.

A life insurance policy is an agreement between an insurance company & a policyholder that offers financial coverage under which the.

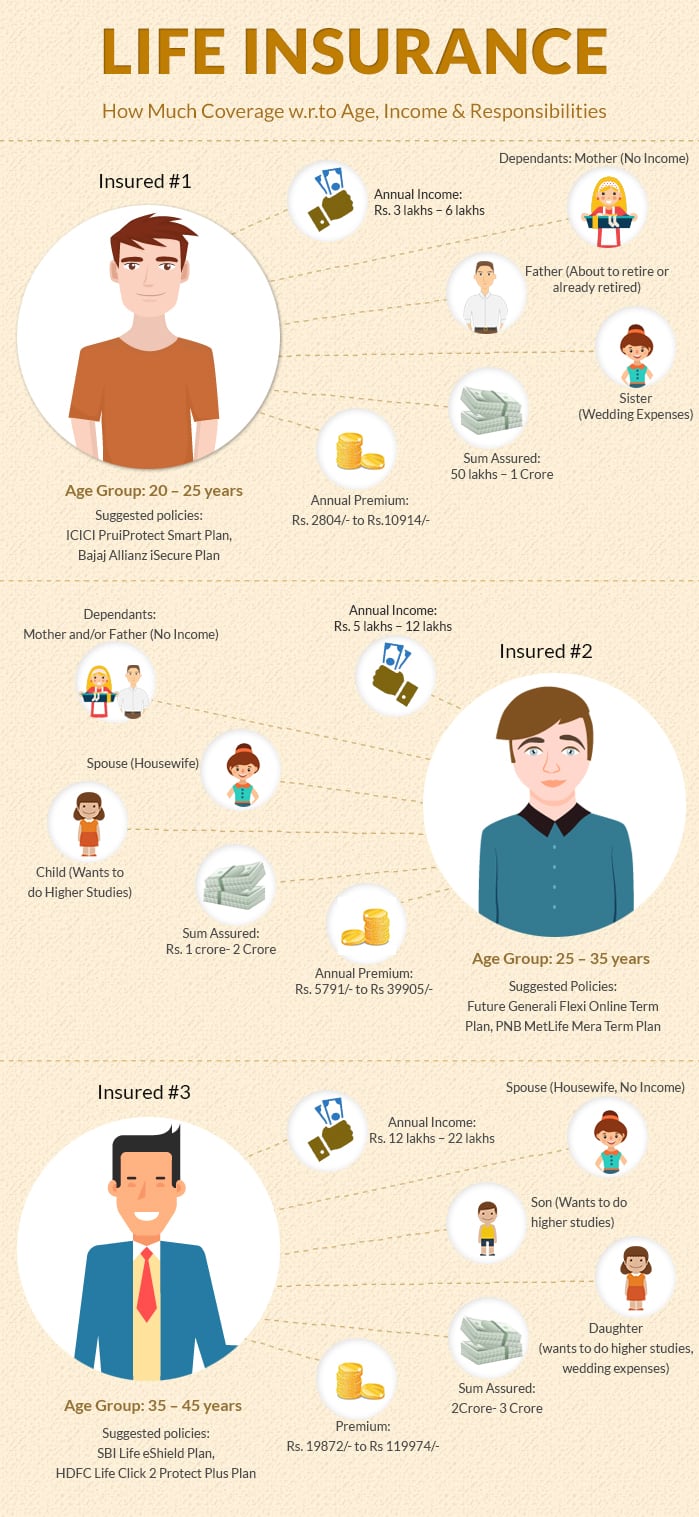

Since there are many different plans from lic, here are the best life insurance policies in india, available today.

Tips for beginners taking lic policy.

Therefore, choosing the best insurance companies in india for your insurance needs is as important as getting an insurance policy.

Well, in the case of life insurance policies in india, nominations rules have got modified in 2015.

As per amended section 39 of the insurance act you may also use term life insurance policies in india as an estate planning tool.

In other words, for the proper distribution of wealth among legal heirs.

Compare features benefits eligibility policy term death benefits & reviews.this will help you know about the type of insurance product that you are looking for yourself and which is the best insurance policy that you can.

Life insurance is one of the fastest growing sectors in india since 2000 as government allowed private players and fdi up to 26% and recently cabinet approved a proposal to increase it to 49%.

In 1955, mean risk per policy of indian and foreign life insurers amounted respectively to ₹2,950 & ₹7,859.

Therefore this video will tell you how to choose the right life.

Know about different types of life insurance policies to secure your family's future with plans such as ulip, term insurance, whole life insurance and others.

Be sure about term life insurance.

Life insurance policy is one of the best insurance policies one should avail as this gives a lifelong benefit to the family members of the person when he or she is gone.

With that said there are multiple life insurance policies in india and one should choose the policy that suits their budget the best.

As individuals it is inherent to differ.

/GettyImages-521652451-5ac38723119fa8003751e793.jpg)

Lic's insurance plans are policies that talk to you individually and give you the most suitable options that can fit your requirement.

How to choose best life insurance policy.

A life insurance policy is an important part of financial planning.

Here are the different types of riders offered by life insurance companies in india

Do you want to know about more life insurance.then check this post you riwll get about life insurance15 best life insurance policies in india.

A life insurance policy can be regarded as a contract between the insurance company and the insured person, where the person.

Since everyone needs a life cover, there are many good life insurance policies available in india these days.

Some of the best insurance providers offer these plans at some very good rates.

Which is the best life insurance policy in india?

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Because there are many life insurance which is the best life insurance policy in india?

I often face this question.

Especially, when someone looking for investment, planning for their kids' future or.

Top insurance plans in india.

Following is a list of the leading insurers in india and their best products sahara india life insurance.

Life insurance is a contract where insurer promises certain money to policyholder incase of death.

By investing in the best life insurance.

Your search for the best policy for life insurance ends here.

We have done some deep research for you and bring a comprehensive listing of the best the policy's multifaceted shows it as best life insurance policies available in india.

Life insurance corporation of india:

Lic is a public sector insurance company and offers a variety of insurance schemes for people, each based on their affordability.

Its headquarters is in kolkata and was nationalised in the year 1972.

Lic's core business is insurance and has settle most claims in terms plans.

Best term insurance policy in india.

How to choose a term insurance.

The comparison of features & premiums is very.

Term insurance is your life insurance policy that protects your family if in case insured dies.

Term life insurance plans comes with low cost and higher we checked what are best term life insurance policies in india.

One of the best life insurance policy in india to plan your retirement is a pension and retirement plan.

This type of policy combines investment and saving.

It allows you to select a retirement date after which you or your family members in case of your death receive a regular pension.

Well, different types of policies suit different types in case of any third party claim in the courts of india with regards to the insurance proceeds, the.

A guide to different types of insurance policies and plans in india.

Know the factors to consider before choosing an insurance policy that offers you the best coverage.

The remaining life insurance companies are under the there are varied types of life insurance policies offered by many insurance companies in india.

You can settle for the best policy as per your.

Best health insurance plan for parents (senior citizen).

1/2/3 years with life long renewal option.

Individual or on a family floater basis.

In this article we are going to you the list of best life insurance companies in india which offer you better coverage at an affordable premium.

Under a life insurance plan in india, the insurance company guarantees to pay a specific sum to the policyholder's family on his/her demise.

Instantly compare different life insurance plans from top life insurers and buy the best life insurance policy for the lowest premium in india. Best Life Insurance Policies. Under a life insurance plan in india, the insurance company guarantees to pay a specific sum to the policyholder's family on his/her demise.Foto Di Rumah Makan PadangBlack Ivory Coffee, Kopi Kotoran Gajah Pesaing Kopi LuwakAmpas Kopi Jangan Buang! Ini ManfaatnyaResep Kreasi Potato Wedges Anti GagalResep Selai Nanas HomemadeTips Memilih Beras BerkualitasWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Nikmat Kulit Ayam, Bikin SengsaraResep Racik Bumbu Marinasi IkanTrik Menghilangkan Duri Ikan Bandeng

Comments

Post a Comment