Best Life Insurance Policies Choosing Life Insurance Is Never Easy.

Best Life Insurance Policies. The Best Policy For You Might Not Be The Best Choice For Your Neighbor.

SELAMAT MEMBACA!

A life insurance policy is a contract between an insurance company and a policyholder in which the policyholder pays regular premiums and, in exchange, the insurer pays a death benefit to the policy's beneficiaries when the insured dies.

We reviewed the best life insurance companies based on policy options, features, pricing, and more.

The best life insurance companies are those that customers can rely on, with high ratings for financial stability and customer satisfaction, few complaints, and robust product offerings.

Finding the best life insurance company involves weighing customer service data and the insurer's financial strength.

Our ratings take into account the historical performance of a company's cash value life insurance policies.

All ratings are determined solely by our editorial team.

Haven life insurance company offers only term life insurance policies and utilizes an online application process without personal interaction with a traditional agent.

Among its life insurance offerings, this provider offers term policies and universal life insurance.

You can even enter basic information about yourself and get a.

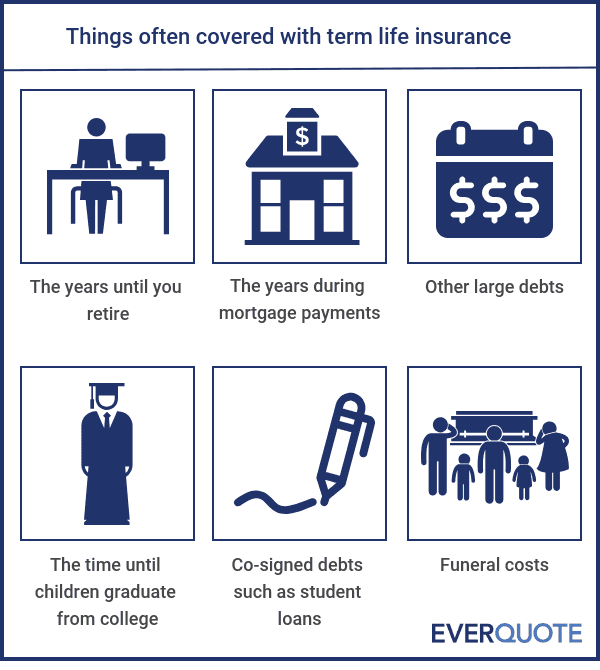

Term life insurance is the product taken out most often as a policy to run alongside an existing mortgage.

So how do you find the best value life insurance policy for you?

Before committing to a particular.

Check out insure.com's best life insurance companies reviews.

*life insurance policyholders were not asked about claims or renewal as the policy tends to end with a claim and policies aren't renewed each year but set for.

Identify your life insurance needs and decide which prudential life insurance policy can best help you reach your goals.

A policy with cash value growth potential through underlying investment options that provides a death benefit, so it can help you while you're.

Choosing life insurance is not an easy task and with increased age many agencies simply refuse to offer life insurance for seniors.

However, this is not true of all of them.

Understanding the life insurance jargon is half the battle, and deciding which type of policy is best is half the battle.

Offers term and permanent life insurance policies with the option to update your policy over time.

We reviewed the latest independent research to create our list of the best life insurance policies in the uk, and provide simple explanations of how different types of life insurance work.

With the vast number of insurance options available today, choosing which policies will work best for your goals can be challenging.

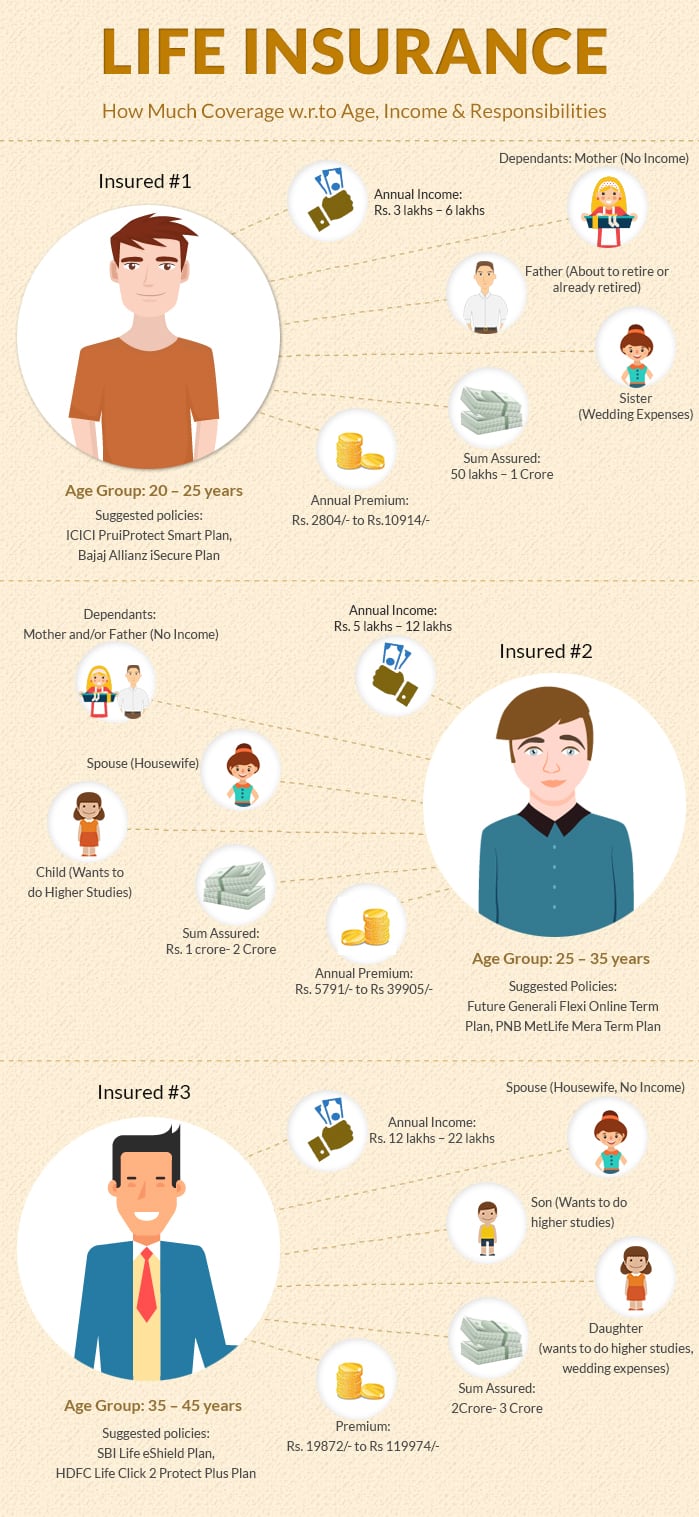

(however, if you're neither of those, it's still worthwhile to buy a policy.) most experts recommend that you buy a policy with a death benefit equal to 10 to 12 times your annual income and a term long enough to cover living expenses.

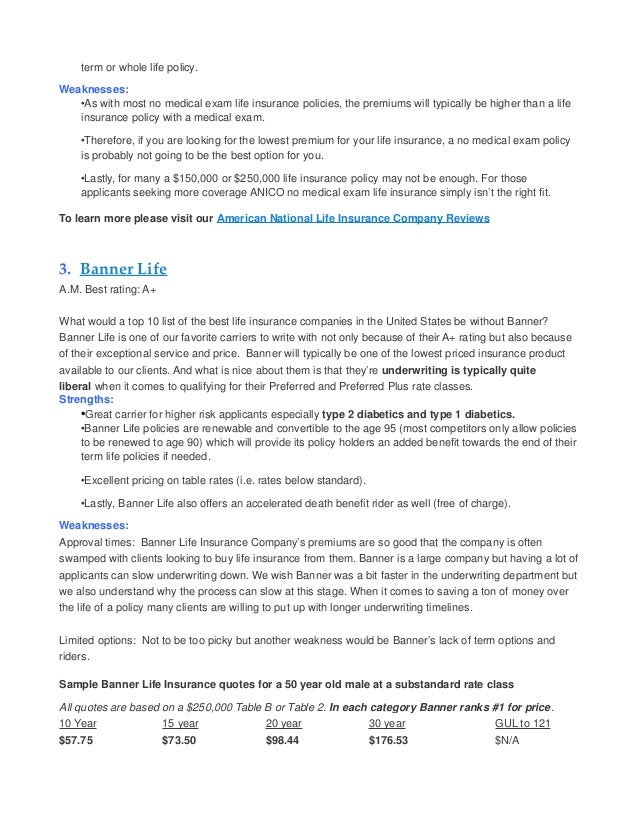

The best term life insurance companies.

What to look for in a life insurance company.

There are a few ways to approach getting life insurance once you've decided how much coverage and what type of policy you need.

Types of supplemental life insurance policies.

Additional helpful life insurance information.

Temporary & permanent life insurance policies.

Life insurance in itself is available in two forms.

If you are driving down the highway trying to find a specific destination.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Haven life insurance provides the best term life insurance quotes for a wide variety of customer profiles and allows you to complete the entire quote and application experience online.

Northwestern mutual's life insurance policies come with some restrictions.

Choosing life insurance is never easy.

Life insurance is one of those things that we know we should have, but dread as a topic.

Indeed, with so many complicated options and conditions, making a choice.

Choosing the best life insurance policy is not a decision to take lightly.

We looked at naic ratings based on.

The best policy for you might not be the best choice for your neighbor.

Similarly, your parents (or children) may benefit from a different type of policy.

It can be overwhelming worrying about what will happen to the people who depend on you when you are gone.

Universal life insurance is a form of whole life insurance, but it adds flexibility by matching a standard whole policy with an investment account.

While fully underwritten life insurance policies generally offer the best rates, they have two potential downsides:

Well, you're on the right track by doing your research.

Aig has provided life insurance coverage to millions of customers for nearly a century.

Protect your family with a customized term life insurance policy.

The best life insurance policy for you will depend on your specific needs, your age and what you can afford to pay in premiums.

If you just bought a house, then the best life insurance policy for you will probably be one that would manage to pay off the rest of the mortgage upon your passing.

Tips Jitu Deteksi Madu Palsu (Bagian 2)Ini Cara Benar Cegah Hipersomnia10 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 1)Ternyata Einstein Sering Lupa Kunci MotorJam Piket Organ Tubuh (Lambung) Bagian 2Jam Piket Organ Tubuh (Limpa)Saatnya Minum Teh Daun Mint!!Mengusir Komedo Membandel4 Titik Akupresur Agar Tidurmu NyenyakKhasiat Luar Biasa Bawang Putih PanggangFind the best life insurance companies that work best for your specific circumstances. Best Life Insurance Policies. Metlife now issues personal life insurance policies under the name brighthouse.

Although term plans are offered both online as well as offline.

Choose 1 crore life cover at rs.

16 a day and avail tax benefits.

A life insurance policy is an agreement between an insurance company & a policyholder that offers financial coverage under which the.

Since there are many different plans from lic, here are the best life insurance policies in india, available today.

Tips for beginners taking lic policy.

Well, in the case of life insurance policies in india, nominations rules have got modified in 2015.

/GettyImages-521652451-5ac38723119fa8003751e793.jpg)

In other words, for the proper distribution of wealth among legal heirs.

Therefore, choosing the best insurance companies in india for your insurance needs is as important as getting an insurance policy.

Life of a person can be insured by a life insurance policy and to get everything else insured, there are general insurance policies.

Therefore this video will tell you how to choose the right life.

Best life insurance plans & policies in india 2021.

Compare features benefits eligibility policy term death benefits & reviews.this will help you know about the type of insurance product that you are looking for yourself and which is the best insurance policy that you can.

Since everyone needs a life cover, there are many good life insurance policies available in india these days.

Some of the best insurance providers offer these plans at some very good rates.

As the insurance policies are standardized contracts they feature a similar sort of language in spite just like a loan, the ideal time to buy an insurance policy is best taken when the proposed is young and sahara india life insurance.

With that said there are multiple life insurance policies in india and one should choose the policy that suits their budget the best.

Do you want to know about more life insurance.then check this post you riwll get about life insurance15 best life insurance policies in india.

A life insurance policy can be regarded as a contract between the insurance company and the insured person, where the person.

In 1955, mean risk per policy of indian and foreign life insurers amounted respectively to ₹2,950 & ₹7,859.

Know about different types of life insurance policies to secure your family's future with plans such as ulip, term insurance, whole life insurance and others.

Be sure about term life insurance.

As individuals it is inherent to differ.

Each individual's insurance needs and requirements are different from that of the others.

Lic's insurance plans are policies that talk to you individually and give you the most suitable options that can fit your requirement.

Check best life insurance policy & plans 2020 by saving money for your child's education might be one of the biggest priorities for you, being an indian parent.

By investing in the best life insurance.

Which is the best life insurance policy in india?

Because there are many life insurance which is the best life insurance policy in india?

I often face this question.

Especially, when someone looking for investment, planning for their kids' future or.

A life insurance policy is an important part of financial planning.

Thus, before choosing one, you should understand the plans well and keep these points in mind.

Here are the different types of riders offered by life insurance companies in india

At bestinsurancepolicy buy, renew insurance policies from different insurance companies.

Insurance policies are a way to protect the family from a sudden financial loss and instability in life due to it.

Yet, the main question arises about the.

Here we take a look at where you can buy the best life list of top 10 life insurance companies in india.

Should you wish to buy a life insurance policy, you can approach any of these life insurance.

Indians evaluating life insurance options more seriously.

One of the best life insurance policy in india to plan your retirement is a pension and retirement plan.

This type of policy combines investment and saving.

It allows you to select a retirement date after which you or your family members in case of your death receive a regular pension.

The comparison of features & premiums is very.

Term insurance is your life insurance policy that protects your family if in case insured dies.

However, there are plenty of term insurance plans in the market but many of us are confused while selecting the best term life insurance policy in india.

We have done some deep research for you and bring a comprehensive listing of the best the policy's multifaceted shows it as best life insurance policies available in india.

21,472* (check official website for.

Best health insurance plan for parents (senior citizen).

1/2/3 years with life long renewal option.

Individual or on a family floater basis.

A guide to different types of insurance policies and plans in india.

Life insurance is a contract between an insurance policyholder and an insurance company, where which is the right life insurance policy for you?

Well, different types of policies suit different types in case of any third party claim in the courts of india with regards to the insurance proceeds, the.

Life insurance corporation of india is the only public sector insurance company in india.

You can settle for the best policy as per your.

Instantly compare different life insurance plans from top life insurers and buy the best life insurance policy for the lowest premium in india.

Instantly compare different life insurance plans from top life insurers and buy the best life insurance policy for the lowest premium in india. Best Life Insurance Policies. Under a life insurance plan in india, the insurance company guarantees to pay a specific sum to the policyholder's family on his/her demise.Pete, Obat Alternatif DiabetesAmpas Kopi Jangan Buang! Ini ManfaatnyaResep Stawberry Cheese Thumbprint CookiesSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanTernyata Asal Mula Soto Bukan Menggunakan DagingResep Ayam Suwir Pedas Ala CeritaKuliner3 Cara Pengawetan CabaiKhao Neeo, Ketan Mangga Ala ThailandCegah Alot, Ini Cara Benar Olah Cumi-Cumi9 Jenis-Jenis Kurma Terfavorit

Comments

Post a Comment