Best Life Insurance Policies See The Individual Company Page To See How They Performed With Members.

Best Life Insurance Policies. A Paramedical Professional Typically Takes Blood Life Insurance Premiums Typically Stretch For Years Into The Future, So It's Worth Spending Time Now To Lock In The Best Rate You Can.

SELAMAT MEMBACA!

A life insurance policy is a contract between an insurance company and a policyholder in which the policyholder pays regular premiums and, in exchange, the insurer pays a death benefit to the policy's beneficiaries when the insured dies.

We reviewed the best life insurance companies based on policy options, features, pricing, and more.

The best life insurance companies are those that customers can rely on, with high ratings for financial stability and customer satisfaction, few complaints, and robust product offerings.

Finding the best life insurance company can mean navigating a bewildering range of product features and pricing variables.

Haven life insurance company offers only term life insurance policies and utilizes an online application process without personal interaction with a traditional agent.

A fully underwritten life insurance policy typically requires a life insurance medical exam.

A paramedical professional typically takes blood life insurance premiums typically stretch for years into the future, so it's worth spending time now to lock in the best rate you can.

The best life insurance companies below offer superior products and customer service, and they exhibit financial strength and stability.

Among its life insurance offerings, this provider offers term policies and universal life insurance.

You can even enter basic information about yourself and get a.

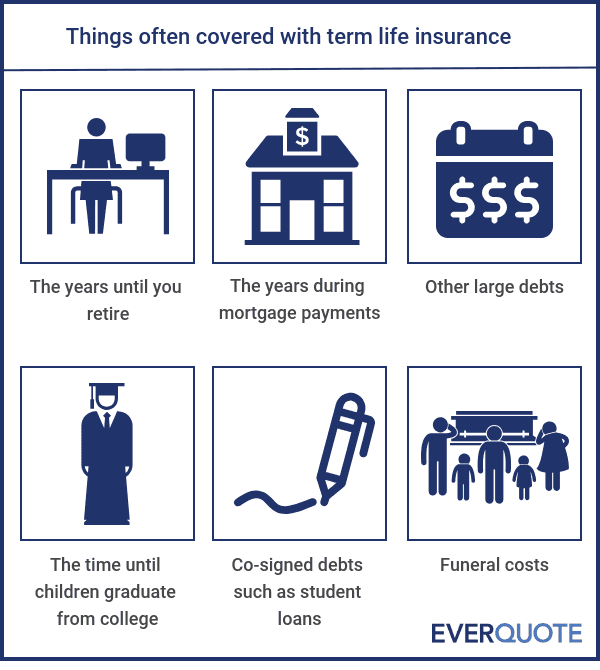

Term life insurance is not only for mortgage holders, but a term policy could also be your best bet to cover the expenses of your family and children whilst they are still dependent on you.

Check out insure.com's best life insurance companies reviews.

See the individual company page to see how they performed with members.

Unlike term life insurance, which lasts up to 20 years, a permanent policy does exactly what the name suggests and.

Research types of life insurance policies, provider coverage options and compare the best life insurance companies using hundreds of customer reviews.

Top picks include policygenius and haven life.

How we chose the best life insurance companies.

All the providers profiled here satisfy the minimum requirements for a life insurance company.

Haven life insurance provides the best term life insurance quotes for a wide variety of customer profiles and allows you to complete the entire quote and application experience online.

We reviewed the latest independent research to create our list of the best life insurance policies in the uk, and provide simple explanations of how different types of life insurance work.

Identify your life insurance needs and decide which prudential life insurance policy can best help you reach your goals.

A policy with cash value growth potential through underlying investment options that provides a death benefit, so it can help you while you're.

Learn more about what kind of life insurance policies might be best for you as you age in place.

Life insurance is one of those things that we know we should have, but dread as a topic.

Indeed, with so many complicated options and conditions, making a choice.

Additional helpful life insurance information.

What's the best type of life insurance policy for you?

Temporary & permanent life insurance policies.

Best life insurance companies reviews.

If you're looking for a simplified and more efficient way of shopping for term life insurance online, any of ethos offers term and life insurance policies from insurers with a long history in the industry, including legal and general america, ameritas, and aaa.

With the vast number of insurance options available today, choosing which policies will work best for your goals can be challenging.

Protect your family with a customized term life insurance policy.

Choosing the best life insurance policy is not a decision to take lightly.

The insurance company's history, as well as its reputation for customer service, financial stability and pricing, are just a few of the things that can impact both your experience and policy value.

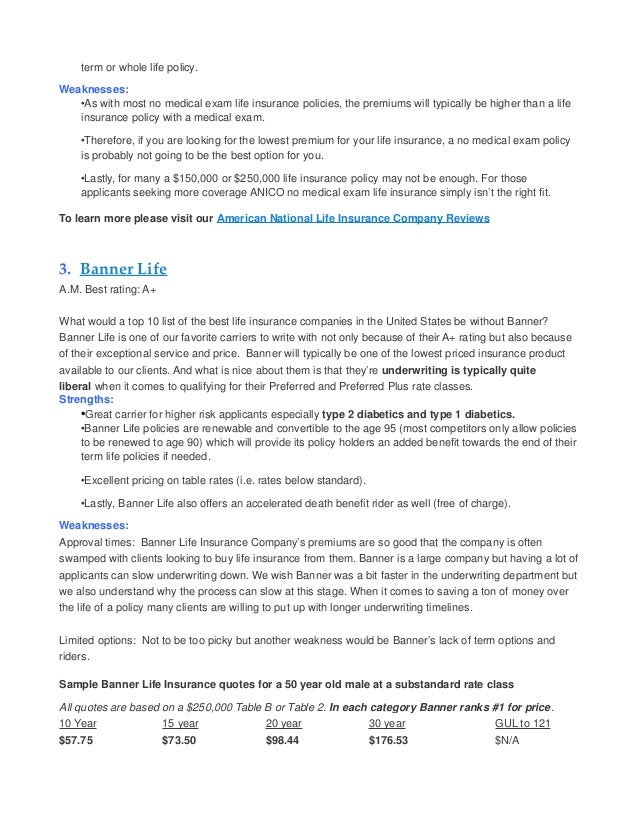

However, purchasing a survivorship life insurance policy is often less expensive than buying two different life insurance policies.

Additionally, there may be less stringent life insurance underwriting criteria for such policies, especially in cases where one of the insured individuals is in good health.

Choosing life insurance is not an easy task and with increased age many agencies simply refuse to offer life insurance for seniors.

Understanding the life insurance jargon is half the battle, and deciding which type of policy is best is half the battle.

If you are driving down the highway trying to find a specific destination.

The life insurance companies can offer you the best life insurance policy at the lowest rates possible.

But effectively leveraging life insurance to protect your loved ones relies on taking out the right policy with the right company.

Term life insurance these types of life insurance policies provide both a fixed premium (the amount you'll pay) as well as a fixed death benefit (the amount we'd pay your family).

Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations.

We help customers realize their hopes and dreams by providing the best products and services to protect them from life's uncertainties and prepare them for the future.

Learn about the best life insurance companies, how to find the best coverage for you and how to when it comes to life insurance, you'll want to find something that provides sufficient coverage but and northwestern mutual pioneered a new hybrid of whole and term life insurance policies called.

But pacific life stands out for having plenty of life insurance policy options

Similarly, your parents (or children) may benefit from a different type of policy.

Many people have life insurance coverage through an employer but these types of policies tend to have low coverage amounts.

Cara Benar Memasak SayuranSaatnya Bersih-Bersih UsusMana Yang Lebih Sehat, Teh Hitam VS Teh Hijau?6 Khasiat Cengkih, Yang Terakhir Bikin HebohResep Alami Lawan Demam Anak5 Khasiat Buah Tin, Sudah Teruji Klinis!!Melawan Pikun Dengan ApelTernyata Tidur Terbaik Cukup 2 Menit!Cara Baca Tanggal Kadaluarsa Produk MakananSalah Pilih Sabun, Ini Risikonya!!!Many people have life insurance coverage through an employer but these types of policies tend to have low coverage amounts. Best Life Insurance Policies. As noted above, mutual of omaha invites new applicants for life insurance all the way up to age 74, and north.

The right life insurance policy can offer affordable protection—and peace of mind—for decades to come.

To find the best life insurance for parents.

We considered a variety of important factors such as price, availability, ease.

We reviewed the best life insurance for parents to help you pick the best one for your needs.

Best life insurance for new parents.

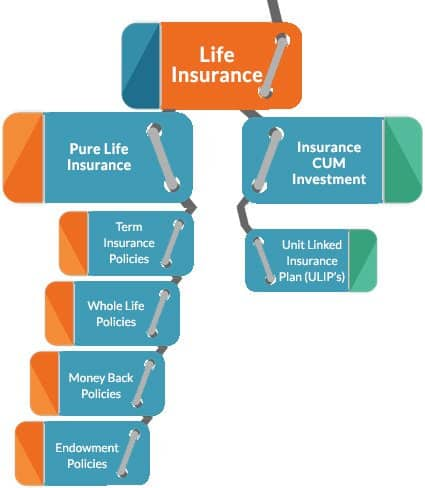

There are two main types of life insurance:

Term life and permanent life.

When deciding on the best life insurance policy for your young family, keep in mind:

It's not just the breadwinner who needs life insurance.

We reviewed the best life insurance for parents based on reputation, coverage, needs, cost, and more.

Sure, carrying a life insurance policy adds another monthly bill to your budget.

It can also be hugely beneficial to your family.

Here are a few reasons parents should consider purchasing life insurance:

Is buying life insurance on my parents a good deal?

Prior to age 85, it seems life insurance can still be purchased for a relatively affordable premium.

As you can see, the older your parents get, the higher the cost for the same coverage.

Traditionally, parents buy whole life policies for themselves and often for their children.

Whole life pays the face value of the policy, which you term life insurance provides coverage for a fixed term, like 10 to 30 years.

If the insured person dies during the specified term, the policy pays the full value.

/GettyImages-521652451-5ac38723119fa8003751e793.jpg)

Comparing multiple policies at once.

Online aggregators make comparison shopping shopping for life insurance as a new parent can feel overwhelming and even a little scary.

After all, it's coverage that you'll never use unless you pass.

Also, working with a financial professional can help families find the best policy for their needs, whatever size and type of policy they're.

Buying life insurance for your parents is possible, and this guide will tell you everything you need to know.

You'll see a list of tips to help you find the best policy, see prices, how 10 tips when buying life insurance policy for your parents.

Term life policies are basic and always good for children leaving home for the first time.

With a term life policy in place they can change to a permanent term life, universal life, and whole life policies are all fantastic choices for children that are looking at life insurance policies for senior parents.

When considering buying life insurance policies for parents, there are some steps that you should take prior to moving forward.

Comparing life insurance policies will help you get the best deal on life insurance for your parents.

Insurify helps you get quotes quickly without having to talk to an insurance agent until you're ready.

Try insurify's quote comparison tool today so you can enjoy financial security while honoring your.

It's just demands are that the insured person have the mental capacity to authorize a lawful contract as well as they stay in a state where ensured life insurance is allowed.

Which type of insurance policy is best for your parents?

When it comes to life insurance policies, there are two main types to consider.

They can both cover your parents with similar amounts of life insurance, but they.

What is the best life insurance for my parents?

Typically when looking for a policy for your parents, you are when buying life insurance which type of life insurance policy is best will be determined by your parent's health if they are in good/moderate health then a guaranteed universal life policy.

Did one of them just have a stroke or a major surgery?

If they just take prescriptions for high blood pressure and cholesterol and are otherwise in good health, they can get any policy they.

Getting life insurance on a sick parent isn't an issue;

Dark, i know, but we are all aware that not everyone has good intentions.

Here is a list of 10 best child insurance policies available to indian parents.

One of the major life insurance companies in india, bajaj allianz life insurance co.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Getting a life insurance policy online.

There's no single best life insurance policy for parents, because everyone is different.

However, some life insurance policies are better suited to new or young parents.

So, you're thinking that buying life insurance on your parents may be a good idea.

Purchasing life insurance on someone else without their consent is considered insurance fraud and is illegal.

Is buying life insurance for parents a good investment?

Permanent life insurance is often thought of as the best life insurance coverage for senior or elderly parents.

There are two popular permanent life insurance options known as interested in a life insurance policy for your parents?

Top quote life insurance is a great starting point.

Once this is established, you need to determine how much coverage will be necessary and what type of coverage will best serve your needs, and those of your.

Purchasing life insurance for your parents.

Will require the consent of your parents.

I have stayed generic since the answer is relevant for all markets.

However the logic hold good in a range for all products in the two categories discussed.

A life insurance policy purchased on a babies' life will likely be an asset for the child well into their adulthood term life insurance is not offered for babies and young children because there would be little justification for parents to purchase a life insurance policy that will expire at such a young age.

If you are wondering if buying life insurance for your parents is a good idea, you tip:

If you decide that you have to get a policy for your parents, make sure to read about our life insurance companies ratings.

The least expensive life insurance for new parents is term life insurance.

Both parents control their policies, including beneficiaries.

And purchasing two individual policies is a better choice than a joint policy that covers both parents on one policy and is not much more expensive. Best Life Insurance Policies. Both parents control their policies, including beneficiaries.Resep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangBuat Sendiri Minuman Detoxmu!!3 Cara Pengawetan CabaiSejarah Gudeg JogyakartaResep Ayam Suwir Pedas Ala CeritaKulinerKuliner Legendaris Yang Mulai Langka Di DaerahnyaResep Beef Teriyaki Ala CeritaKulinerKuliner Jangkrik Viral Di JepangSejarah Nasi Megono Jadi Nasi TentaraTernyata Bayam Adalah Sahabat Wanita

Comments

Post a Comment