Best Life Insurance Policies Banner Life Insurance Policies Are Issued By Legal And General America, The American Branch Of The British Multinational Financial Services Company.

Best Life Insurance Policies. With The Vast Number Of Insurance Options Available Today, Choosing Which Policies Will Work Best For Your Goals Can Be Challenging.

SELAMAT MEMBACA!

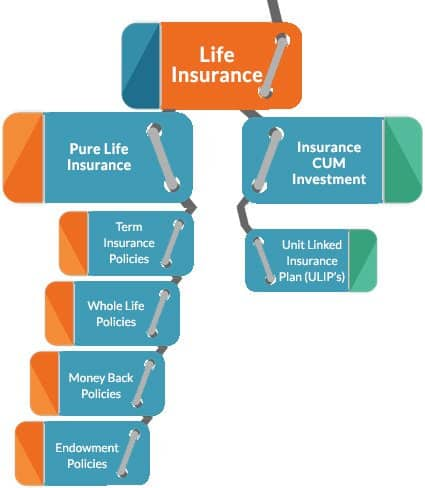

A life insurance policy is a contract between an insurance company and a policyholder in which the policyholder pays regular premiums and, in exchange, the insurer pays a death benefit to the policy's beneficiaries when the insured dies.

We reviewed the best life insurance companies based on policy options, features, pricing, and more.

The best life insurance companies are those that customers can rely on, with high ratings for financial stability and customer satisfaction, few complaints, and robust product offerings.

Finding the best life insurance company can mean navigating a bewildering range of product features and pricing variables.

Haven life insurance company offers only term life insurance policies and utilizes an online application process without personal interaction with a traditional agent.

A fully underwritten life insurance policy typically requires a life insurance medical exam.

A paramedical professional typically takes blood life insurance premiums typically stretch for years into the future, so it's worth spending time now to lock in the best rate you can.

The best life insurance companies below offer superior products and customer service, and they exhibit financial strength and stability.

Among its life insurance offerings, this provider offers term policies and universal life insurance.

You can even enter basic information about yourself and get a.

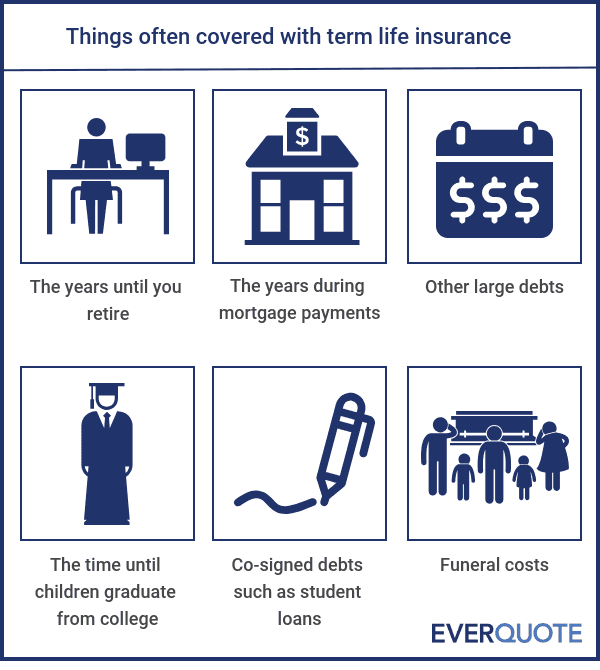

Term life insurance is not only for mortgage holders, but a term policy could also be your best bet to cover the expenses of your family and children whilst they are still dependent on you.

Check out insure.com's best life insurance companies reviews.

See the individual company page to see how they performed with members.

Unlike term life insurance, which lasts up to 20 years, a permanent policy does exactly what the name suggests and.

Research types of life insurance policies, provider coverage options and compare the best life insurance companies using hundreds of customer reviews.

Top picks include policygenius and haven life.

How we chose the best life insurance companies.

All the providers profiled here satisfy the minimum requirements for a life insurance company.

Haven life insurance provides the best term life insurance quotes for a wide variety of customer profiles and allows you to complete the entire quote and application experience online.

We reviewed the latest independent research to create our list of the best life insurance policies in the uk, and provide simple explanations of how different types of life insurance work.

Identify your life insurance needs and decide which prudential life insurance policy can best help you reach your goals.

A policy with cash value growth potential through underlying investment options that provides a death benefit, so it can help you while you're.

Learn more about what kind of life insurance policies might be best for you as you age in place.

Life insurance is one of those things that we know we should have, but dread as a topic.

Indeed, with so many complicated options and conditions, making a choice.

Additional helpful life insurance information.

What's the best type of life insurance policy for you?

Temporary & permanent life insurance policies.

Best life insurance companies reviews.

If you're looking for a simplified and more efficient way of shopping for term life insurance online, any of ethos offers term and life insurance policies from insurers with a long history in the industry, including legal and general america, ameritas, and aaa.

With the vast number of insurance options available today, choosing which policies will work best for your goals can be challenging.

Protect your family with a customized term life insurance policy.

Choosing the best life insurance policy is not a decision to take lightly.

The insurance company's history, as well as its reputation for customer service, financial stability and pricing, are just a few of the things that can impact both your experience and policy value.

However, purchasing a survivorship life insurance policy is often less expensive than buying two different life insurance policies.

Additionally, there may be less stringent life insurance underwriting criteria for such policies, especially in cases where one of the insured individuals is in good health.

Choosing life insurance is not an easy task and with increased age many agencies simply refuse to offer life insurance for seniors.

Understanding the life insurance jargon is half the battle, and deciding which type of policy is best is half the battle.

If you are driving down the highway trying to find a specific destination.

The life insurance companies can offer you the best life insurance policy at the lowest rates possible.

But effectively leveraging life insurance to protect your loved ones relies on taking out the right policy with the right company.

Term life insurance these types of life insurance policies provide both a fixed premium (the amount you'll pay) as well as a fixed death benefit (the amount we'd pay your family).

Term life insurance is a popular option because it boasts benefits that are attractive to people of most ages and situations.

We help customers realize their hopes and dreams by providing the best products and services to protect them from life's uncertainties and prepare them for the future.

Learn about the best life insurance companies, how to find the best coverage for you and how to when it comes to life insurance, you'll want to find something that provides sufficient coverage but and northwestern mutual pioneered a new hybrid of whole and term life insurance policies called.

But pacific life stands out for having plenty of life insurance policy options

Similarly, your parents (or children) may benefit from a different type of policy.

Many people have life insurance coverage through an employer but these types of policies tend to have low coverage amounts.

PD Hancur Gegara Bau Badan, Ini Solusinya!!Fakta Salah Kafein KopiTernyata Tidur Bisa Buat MeninggalMengusir Komedo Membandel - Bagian 24 Titik Akupresur Agar Tidurmu NyenyakIni Cara Benar Cegah HipersomniaIni Manfaat Seledri Bagi KesehatanMulti Guna Air Kelapa HijauPentingnya Makan Setelah OlahragaSehat Sekejap Dengan Es BatuMany people have life insurance coverage through an employer but these types of policies tend to have low coverage amounts. Best Life Insurance Policies. As noted above, mutual of omaha invites new applicants for life insurance all the way up to age 74, and north.

The best life insurance, uk wide, usually only covers you for death.

Start by looking at your debts, your family's needs and their lifestyle.

We reviewed the latest independent research to create our list of the best life insurance policies in the uk, and provide simple explanations of how different types of life insurance work.

Trying to decide on a life insurance policy can be hard work.

Quotes from leading uk insurers.

You'll get the same great price as buying online.

An example of life insurance would be level or decreasing term cover, which only pays out if you pass away during the policy.

Which life insurance providers have the best payout rates?

If you are going to spend your hard earned money on a life insurance policy you there are more than 10 major uk life insurance providers to compare.

Despite the high number of insurers, it's important to compare all of them when.

There are three main types of life insurance policies available how long should my life insurance policy last?

As for the term, you may choose to insure yourself for the length of your mortgage, until your children have finished full time education, or until your partner.

Certain life policies and so on.

Shares in a uk reit or an overseas equivalent.

The rights under a life insurance policy are often owned by more than one person.

The general rule is that each interested person is chargeable on the share of the total.

It's up to you how much cover you want.

Best life insurance policies for people over 50.

Best uk life insurance cover reviews for 2019.

/GettyImages-521652451-5ac38723119fa8003751e793.jpg)

A life insurance policy is a contract between an insurance company and a policyholder in which the policyholder pays regular premiums and, in exchange, the insurer pays a death benefit to the policy's beneficiaries when the insured dies.

The best life insurance companies can help you secure.

Finding the best life insurance company can mean navigating a bewildering range of product features and pricing variables.

Most term life insurance policies have level benefits and premiums, so the premiums stay the same throughout the term.

Here's a look at how much life insurance premiums typically stretch for years into the future, so it's worth spending time now to lock in the best rate you can.

It's easy to get life.

Of course, finding a great life insurance company has to be done in tandem with finding the best life insurance policy.

A company with a brilliant reputation is no use to you if they don't offer any policies that match what.

The definitive guide to the uk's top 10 life insurance companies.

We review in detail the best uk brands offering life insurance or life and critical illness cover.

How life insurance policy loans work.

Compare life insurance prices from the the leading uk providers.

Life insurance is easy and provides a cost effective solution to ensure your family get the we do not receive any other payment regardless if you take out the policy or not.

We offer affordable life insurance uk wide and critical illness cover from a variety of the uk's leading insurance providers, meaning you aren't compromising on let's face it, no one really likes paying for any type of insurance as, in the best case scenario, you'll never need to claim so it can seem like.

We reviewed the best life insurance companies based on policy options, features, pricing, and more.

Who is the best life insurance providers for 2018.

Find the best insurance companies using price comparisons, claim settlements rate and get a quote and compare the best insurance policy for you, our customer saves more than 35% on premiums rather than going directly to the insureres.

Hsbc life insurance offers you peace of mind, knowing your loved ones are financially protected if the unexpected happens.

Flexibility to switch to longer term, permanent 2allstate lifetime ul® is a flexible premium universal life insurance policy issued by allstate assurance company, 3075 sanders road.

This insurance policy covers you for your entire life.

The insurer invests your premiums in a fund of stocks, shares, property and other investments until a claim is made.

Haven life insurance company offers only term life insurance policies and utilizes an online application process without personal interaction with a traditional agent.

The best life insurance companies below offer superior products and customer service, and they exhibit financial strength and stability.

Before you buy life insurance, you should take the time to compare policies and prices with online providers that have free quote tools.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

When you're looking for life cover, it's a good idea to compare policies according to the protection they offer, as well as the price.

Policies taken out to cover a fixed period of time with a payment only made out if death occurs during the agreed 'term' of the policy.

Life insurance covers the death of the policyholder.

Check out our life insurance chart to understand the plans and what life insurance you may need.

Understanding the different types of life policies.

Answering those questions can help you the prospectus, and, if available, the summary prospectus, contain this information as well as other. Best Life Insurance Policies. Get yourself life insurance cover( uks best life insurance companies ) by filling the above form, because even basic policies cover with our help you could discover a very attractive life insurance policy from a leading uk provider like uks best life insurance companies even today.Ternyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiResep Kreasi Potato Wedges Anti GagalTernyata Asal Mula Soto Bukan Menggunakan DagingStop Merendam Teh Celup Terlalu Lama!Susu Penyebab Jerawat???Resep Stawberry Cheese Thumbprint Cookies3 Jenis Daging Bahan Bakso TerbaikResep Yakitori, Sate Ayam Ala Jepang5 Makanan Pencegah Gangguan PendengaranKuliner Jangkrik Viral Di Jepang

Comments

Post a Comment