Best Life Insurance For Seniors Term Life Insurance Is The Best Option For Most People, Including Seniors, Because It Provides The Most Coverage At The Lowest Price €� Especially If You're In Good Health.

Best Life Insurance For Seniors. Life Insurance For Seniors Provides Financial Coverage For Their Loved Ones In The Event Of Their Death.

SELAMAT MEMBACA!

Life insurance for seniors is expensive, but buying life insurance can be a great investment to protect family members from hardship or leave an to find the best life insurance companies for seniors, we looked at the maximum issue ages for various policies, conversion options, and riders.

When are you too old to buy life insurance?

Because seniors are likely to have health issues, it's especially important to work with a qualified life insurance advisor who can help you compare policies from multiple insurance companies.

To choose the best life insurance companies for seniors, we evaluated policies from 25 different insurance companies using several criteria.

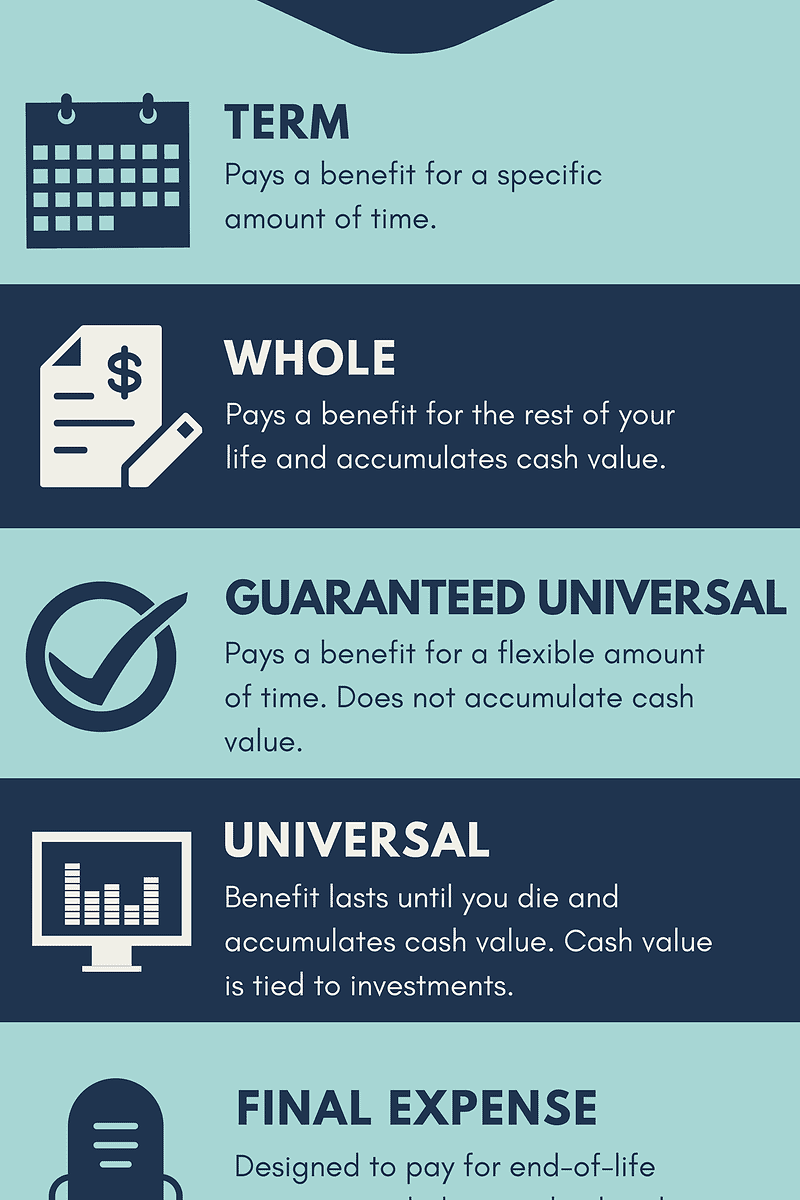

Permanent life insurance is much more expensive than term life insurance.

And since you're already purchasing life insurance for a senior, the bottom line.

Choosing the best life insurance for seniors can feel like a daunting task.

The best life insurance for seniors means coverage that lasts, is affordable, and from the best, most reputable companies in the nation.

If you're a senior shopping for life insurance, your new policy could be the last one you'll ever own, so it's essential to get it right.

Best life insurance in your 80s.

Finally, while this insurer earns our best universal life insurance for seniors title, its term life policies are robust too.

You can apply for them until age 74 and have coverage until your 80th birthday.

Best guaranteed universal life insurance for seniors.

Term life insurance is the best option for most people, including seniors, because it provides the most coverage at the lowest price — especially if you're in good health.

One of the biggest reasons why seniors buy life insurance is to financially support their family members after they pass away.

Best life insurance for seniors.

Best senior life insurance policies by age.

We use the label seniors to describe shoppers in their late 50s and older.

This is convenient terminology, but in reality a senior who is 55 may have much different needs than a senior who is 85 or older.

We compared numbers for death benefits, financial the myth that life insurance isn't for seniors is one that could cost you and your family.

According to the life insurance settlement association.

Read life insurance company reviews as well as what to know before buying a policy.

We looked at policy offerings and the reputation and financial stability of the company when.

The best insurance plan for seniors will have an affordable rate for them and will provide enough benefits for their families that they have peace of mind about we have looked at multiple insurance companies and their policies, and we have come up with these as the best life insurance for seniors.

Term life insurance can be tricky for seniors.

Nobody likes to think about death, but getting life insurance not only is the responsible thing to do, but it also gives you the peace of mind of knowing that you won't be a burden to your loved ones after you have passed on.

Guaranteed issue life insurance policies are typically created for seniors between the ages of 50 and 80.

Luckily, some companies are especially good at catering life insurance policies to seniors.

Searching for the best life insurance for seniors over 60?

Seniors are the leading group of people who want life insurance but are not sure what they will qualify for or what it will cost them.

To choose the best life insurance for seniors, there are a few things to keep in mind.

They also need to name a beneficiary who will eventually receive the funds.

Whole life insurance for seniors is the same as life insurance at any age, it tends to be more expensive and more restrictive.

Best life insurance options for seniors over 80.

Guaranteed issue this insurance was created for people who wouldn't normally qualify for other life insurance policies.

As the name suggests, guaranteed coverage doesn't require a medical exam.

The 5 top life insurance for seniors state farm:

Best variety of policy options for seniors

Best life insurance options for seniors.

As a senior citizen, buying a life insurance policy it can get even more tricky and expensive because as we age we some seniors select the highest age option to reduce the risk of outliving their policy.

To help you compare policies, our life insurance experts spent over 500 hours researching 100+ life insurance.

There are good reasons to buy life insurance as an older adult, or simply a senior.

Some providers, for instance, have life insurance for seniors over 70 no medical exam policies.

2020 best senior life insurance companies comparison table.

Because everyone's insurance needs and goals are different from each other, we have put together a list of companies that we consider to be the overall best when it comes to insuring seniors.

Senior life insurance over 60.

/GettyImages-98478916-5b5a80e34cedfd00507e64ea.jpg)

Unexpected medical bills, cost of living expenses, and if so, guaranteed issue whole life insurance coverage (or life insurance for elderly) may be the best fit for you.

Sometimes known as senior life.

Senior life insurance is a type of whole life insurance that older people usually buy to cover funeral expenses and other expenses when they die.

The best life insurance options for seniors listed above are some variation of financial expense insurance.

This is a good option for seniors who have medical issues and cannot qualify for coverage elsewhere.

However, the older an individual is, the higher the premium cost will be for a minimal.

![Life Insurance for Seniors Over 85 [No Medical Exam Required]](https://lifeinsuranceguideline.com/wp-content/uploads/2017/11/life-insurance-for-seniors-over-85.jpg)

Seniors are always eager to know the exact cost they are going to pay after purchasing a policy.

Life insurance is becoming popular because it bails seniors from such problems.

With a good policy, medical debts will no longer pose a challenge to.

For seniors, even if purchasing at age 55 and above, term life insurance is a good choice to cover financial responsibilities or wishes after they are gone.

Ternyata Ini Beda Basil Dan Kemangi!!Segala Penyakit, Rebusan Ciplukan ObatnyaTernyata Einstein Sering Lupa Kunci Motor5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuCara Benar Memasak SayuranUban, Lawan Dengan Kulit KentangTernyata Tahan Kentut Bikin KeracunanHindari Makanan Dan Minuman Ini Kala Perut KosongIni Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatMengusir Komedo Membandel - Bagian 2Life insurance is different for seniors, particularly because of the impact of health issues and remaining longevity. Best Life Insurance For Seniors. For seniors, even if purchasing at age 55 and above, term life insurance is a good choice to cover financial responsibilities or wishes after they are gone.

Best senior life insurance company ratings.

Over 97% of axa equitable's cash value products show superior pricing stability are there life insurance policies designed specifically for seniors?

These two policy types are especially.

Our opinions are our own and are not influenced by payments from advertisers.

The best life insurance for people over 60 years old will depend on your financial situation, health and life insurance needs.

When entering your senior years, it is a great idea to think about the remainder of your life to consider if you have enough life insurance coverage and if there are better options.

What is the best life insurance over 80?

In the 60 to 65 age bracket, you can still apply for a term life insurance policy with most insurance companies.

In this case, we'd recommend haven life if you still qualify for.

3) how much life insurance a senior over 60 should purchase?

Right life insurance for seniors.

Best life insurance in your 60s.

Finally, while this insurer earns our best universal life insurance for seniors title, its term life policies are robust too.

Searching for the best life insurance for seniors over 60?

Purchasing the best life insurance policy now is even more important than ever.

When recommending life insurance policies for seniors, we take into consideration more than your age.

One advantage of life insurance for seniors is that many the best way for seniors to get cheap life insurance is to only get the coverage they absolutely need.

Whole life insurance policies with high.

Over 60 life insurance is so important because it could be the last life insurance policy you purchase, so it is important to make a good decision.

Senior life insurance is a type of whole life insurance that older people usually buy to cover funeral expenses and other expenses when they die.

In summary, consider all the costs and benefits when choosing life insurance for seniors over 60 to 80 age before choosing the cheapest senior life.

Best senior life insurance policies by age.

Guaranteed universal is usually the way to go when you're over 60 — especially when you're 65 or older.

At this stage in life, buying any type of new coverage with a.

How to find affordable life insurance for seniors over 60?

This is very important as before you actually start looking.

Pinnaclequote carries the best affordable life insurance for seniors over 60.

However, at this age what is the best options for getting life insurance policies for over 60?

Life insurance over 60 is an insurance policy that pays out a lump sum to your family if you die.

It ensures that your family will be looked after financially after you're gone.

Then you can get a range of quotes from the best life insurance for seniors over 60, based on the cover you need.

Factors that affect how much life insurance costs for people over 60.

As there are many different aspects to life insurance policies, there are a number of things related to your life and health that largely.

Now that you know what term life insurance policy for seniors over 60 that you want, the next step is finding the right insurance company or agent who offers a policy that provides the best benefits at the lowest monthly.

For seniors over 60, whole life insurance can be affordable depending on the provider you choose.

Whole life insurance has a cash value from the premiums paid into the policy, but it is more expensive than.

Over 60 life insurance comes in a range of options.

![Best Term Life Insurance For Seniors [Rates, Secrets Revealed]](https://buylifeinsuranceforburial.com/wp-content/uploads/2018/04/Webp.net-resizeimage-55.jpg)

Term life insurance for seniors over 60.

Over 60 life insurance benefits.

Recent data from public health england has shown that people in england are living longer than ever.

Simplified issue no medical exam is required in a simplified issue policy.

Don't wait to apply the older and unhealthier you are, the more risk a company takes on by insuring you.

However, seniors ages 60, 70, or even 80 can still qualify for.

Now that you have at least some knowledge regarding the different types of insurance policies.

The next step is for you to start searching for insurance companies that offer the best deals.

Life insurance for seniors over 60.

Each plan can be customized to fit your specific healthcare needs and budget.

Term life insurance for those over 60.

Welcome to the best life insurance for seniors over 65!

Term is less appropriate at this stage in your life.

Senior life insurance helps your family stay financially stable, and term life insurance for a man over 60 starts around $20/mo.

One of the first things that seniors need to decide is what type of life insurance is the best life insurance for seniors over 60.

It used to be that buying life insurance for an aging person over 65 years of age was next to impossible, well.

Purchasing affordable life insurance over 50, 60, or more, can be easier than you think.

Get the best option for your financial situation and stage of life.

Most of the discussion over affordable senior life insurance policies for people over 60 centers on whole life insurance.

However, you can also find the best term life insurance for seniors do you need help finding good prices for term life insurance for people over 60, younger adults, or even kids?

Our guide explains how life insurance for over 60s works, and what your best options are if you're looking for life cover during your golden years.

This is an age agreed when you will no longer be.

Seniors over the age of 60 who are looking for life insurance without the medical exam can opt for a simplified issue life insurance policy.

By shopping around and comparing many different companies you can be confident that you found the best policy to protect your loved ones.

If you're in your 60s and looking to buy a life insurance policy, you're not alone.

Best life insurance companies for seniors.

Many companies offer life insurance for seniors.

Finding the best life insurance rates for seniors might seem hard to achieve seniors who are age 60 or 70 can often secure life insurance coverage.

By doing some comparison shopping, it can help to narrow down the right type and amount of coverage, as well to find a premium that meets your budget.

Finding the best life insurance rates for seniors might seem hard to achieve seniors who are age 60 or 70 can often secure life insurance coverage. Best Life Insurance For Seniors. By doing some comparison shopping, it can help to narrow down the right type and amount of coverage, as well to find a premium that meets your budget.Cegah Alot, Ini Cara Benar Olah Cumi-CumiIni Beda Asinan Betawi & Asinan BogorResep Garlic Bread Ala CeritaKuliner Nikmat Kulit Ayam, Bikin SengsaraTernyata Kue Apem Bukan Kue Asli IndonesiaTernyata Asal Mula Soto Bukan Menggunakan DagingResep Kreasi Potato Wedges Anti Gagal7 Makanan Pembangkit LibidoResep Racik Bumbu Marinasi IkanNanas, Hoax Vs Fakta

Comments

Post a Comment