Best Life Insurance For Seniors Finally, While This Insurer Earns Our Best Universal Life Insurance For Seniors Title, Its Term Life Policies Are Robust Too.

Best Life Insurance For Seniors. Best Life Insurance For Seniors.

SELAMAT MEMBACA!

Life insurance for seniors is expensive, but buying life insurance can be a great investment to protect family members from hardship or leave an to find the best life insurance companies for seniors, we looked at the maximum issue ages for various policies, conversion options, and riders.

When are you too old to buy life insurance?

Because seniors are likely to have health issues, it's especially important to work with a qualified life insurance advisor who can help you compare policies from multiple insurance companies.

To choose the best life insurance companies for seniors, we evaluated policies from 25 different insurance companies using several criteria.

Permanent life insurance is much more expensive than term life insurance.

And since you're already purchasing life insurance for a senior, the bottom line.

Choosing the best life insurance for seniors can feel like a daunting task.

The best life insurance for seniors means coverage that lasts, is affordable, and from the best, most reputable companies in the nation.

If you're a senior shopping for life insurance, your new policy could be the last one you'll ever own, so it's essential to get it right.

Term life insurance is the best option for most people, including seniors, because it provides the most coverage at the lowest price — especially if you're in good health.

Best life insurance in your 80s.

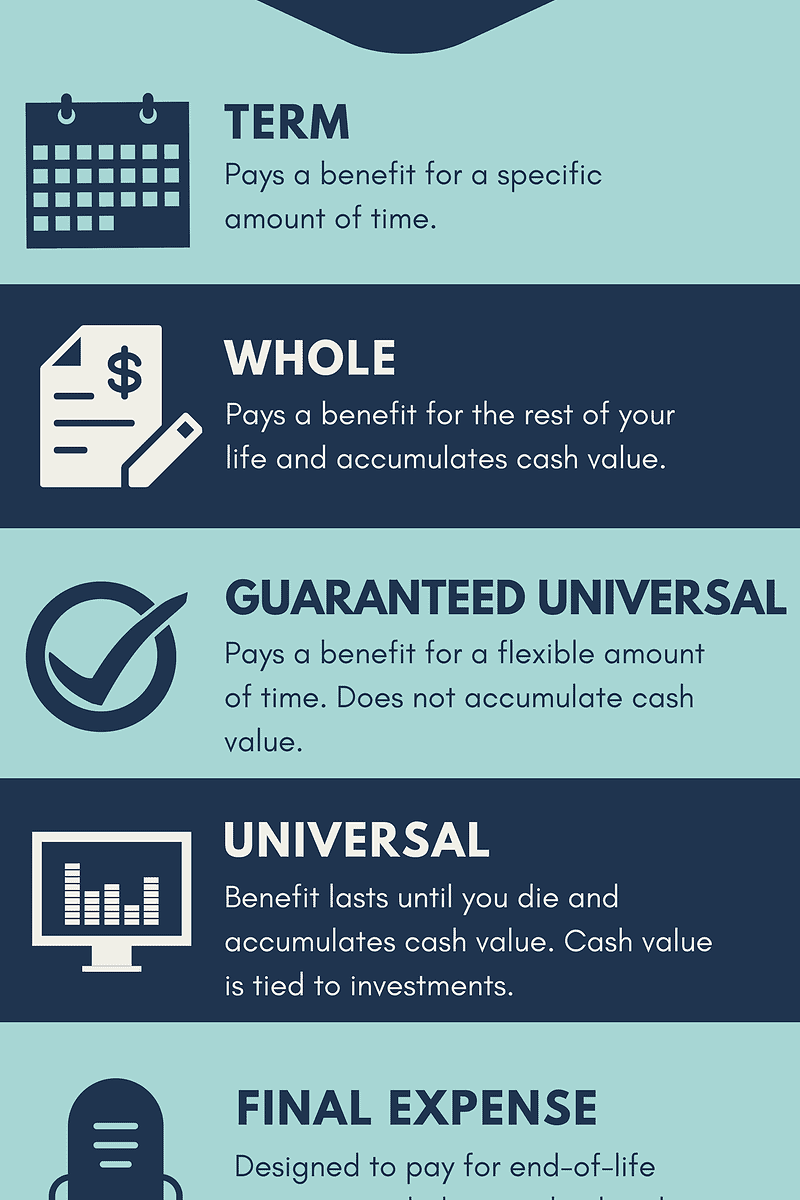

Life insurance types for seniors.

Finally, while this insurer earns our best universal life insurance for seniors title, its term life policies are robust too.

Best guaranteed universal life insurance for seniors.

Guaranteed universal life insurance is the cheapest way for seniors to get permanent life insurance coverage, as policies typically have little to no cash value component.

Guaranteed issue life insurance policies are typically created for seniors between the ages of 50 and 80.

These companies are developing new ways to provide policyholders with peace of mind.

The best insurance plan for seniors will have an affordable rate for them and will provide enough benefits for their families that they have peace of mind about we have looked at multiple insurance companies and their policies, and we have come up with these as the best life insurance for seniors.

Best senior life insurance policies by age.

This is convenient terminology, but in reality a senior who is 55 may have much different needs than a senior who is 85 or older.

Best life insurance for seniors.

These plans are typically purchased from funeral homes, and the payout goes directly to the funeral home to cover specific.

We compared numbers for death benefits, financial ratings, and qualifications from the best life insurance companies for seniors.

Best life insurance policy for seniors over 80.

Guaranteed issue this insurance was created for people who wouldn't normally qualify for other life insurance policies.

/GettyImages-98478916-5b5a80e34cedfd00507e64ea.jpg)

Read life insurance company reviews as well as what to know before buying a policy.

We evaluated an extensive list of life insurance companies and selected the best ones with the most options for seniors.

We looked at policy offerings and the reputation and financial stability of the company when.

Seniors are the leading group of people who want life insurance but are not sure what they will qualify for or what it will cost them.

Best life insurance for seniors [lowest deal available by requesting free quotes].

Nobody likes to think about death, but getting life insurance not only is the responsible thing to do, but it also gives you the peace of mind of knowing that you won't be a burden to your loved ones after you have passed on.

The 5 top life insurance for seniors state farm:

Best customer service mutual of omaha:

Best variety of policy options for seniors

Seniors need to decide how long they need coverage for, how much coverage they want and what they want to use the money for.

They also need to name a beneficiary who will eventually receive the funds.

Best life insurance options for seniors.

Outliving your policy is something most would want to avoid.

Life insurance is different for seniors, particularly because of the impact of health issues and remaining longevity.

For seniors, even if purchasing at age 55 and above, term life insurance is a good choice to cover financial responsibilities or wishes after they are gone.

This is a good option for seniors who have medical issues and cannot qualify for coverage elsewhere.

However, the older an individual is, the higher the premium cost will be for a minimal.

Need help choosing the best senior life insurance company for your life insurance needs?

To help you compare policies, our life insurance experts spent over 500 hours researching 100+ life insurance.

There are good reasons to buy life insurance as an older adult, or simply a senior.

First, you'll get the top picks for term life insurance for seniors.

But rest assured, anyone can still obtain life insurance.

How much life insurance coverage can a senior over 65 qualify for?

How to qualify if you are a senior 65 or older, and interested in learning what type of life insurance is best for your goals, then this video is for you.

And while this… may seem like an easy question to answer, the truth is, if you're looking for an straightforward answer, knowing what the best life insurance for a senior is.

Senior life insurance is a type of whole life insurance that older people usually buy to cover funeral expenses and other expenses when they die.

If you are looking for the best senior life insurance as you approach or enjoy retirement, you have come to the right place.

Seniors are always eager to know the exact cost they are going to pay after purchasing a policy.

Life insurance is becoming popular because it bails seniors from such problems.

8 Bahan Alami Detox Ternyata Madu Atasi InsomniaTernyata Ini Beda Basil Dan Kemangi!!Obat Hebat, Si Sisik Naga4 Manfaat Minum Jus Tomat Sebelum TidurSehat Sekejap Dengan Es BatuTernyata Tidur Bisa Buat MeninggalIni Efek Buruk Overdosis Minum KopiGawat! Minum Air Dingin Picu Kanker!Ini Cara Benar Cegah HipersomniaLife insurance is becoming popular because it bails seniors from such problems. Best Life Insurance For Seniors. With a good policy, medical debts will no longer pose a challenge to.

Your current life insurance policy might not be sufficient for the rest of your life, but there are better options for life insurance for seniors.

Our opinions are our own and are not influenced by payments from advertisers.

Someone turning 65 today has a 70% chance of needing these services in the future. to find the best life insurance companies for seniors.

When you start to consider purchasing life insurance for seniors over 70 you may be met with many confusing options.

Best senior life insurance company ratings.

When are you too old to buy life insurance?

Over 97% of axa equitable's cash value products show superior pricing stability are there life insurance policies designed specifically for seniors?

![Life Insurance for Seniors Over 85 [No Medical Exam Required]](https://lifeinsuranceguideline.com/wp-content/uploads/2017/11/life-insurance-for-seniors-over-85.jpg)

What is the best life insurance over 70?

As noted above, mutual of omaha invites new applicants for life insurance all the way up to age 74, and north american permanent life insurance is much more expensive than term life insurance.

And since you're already purchasing life insurance for a senior.

Foresters offers some of the best term life insurance rates in the market for seniors, and even offers coverage if you're over 70.

Life insurance for seniors isn't as expensive as you think.

Where most life insurance companies won't even issue policies to seniors over 80, transamerica will allow seniors up to 85 to sign up for coverage through both term and whole life insurance policies at reasonable rates.

Unsure between term and whole?

Get guaranteed no medical exam insurance quotes.

Are you a senior over 70 years old looking for life insurance?

The best option would be to find insurance for people over 50 to 70 years old.

Thanks to the majority of senior life insurance over 70 policies sold today, they have provisions that accelerate a large percentage of the death benefit in case a terminal condition is diagnosed.

Permanent policies such as whole life or universal life insurance coverage are available as well.

The best option is to use an agency to help you in finding the right life insurance policy offered by the right insurer who will accept you.

Life insurance for seniors over 70 without medical exam.

Sometimes you may want to avoid going through a medical test because it could negatively impact.

This is a time in life when circumstances require seniors to examine life insurance get instant quotes now.

So how do seniors over 70 end up needing life insurance?

Of course, life insurance is best purchased when.

The most affordable price for seniors is offered.

You are in the right place;

We will guide you to the best life insurance for seniors over 70.

Life insurance for seniors is a type of insurance that older people usually buy to cover funeral expenses and other expenses when they die.

It does not allow you to apply for life insurance for seniors over 70 to 79.

Therefore, you should check with these two companies if you are planning to.

Simplified issue no medical exam is required in a simplified issue policy.

Don't wait to apply the older and unhealthier you are, the more risk a company takes on by insuring you.

However, seniors ages 60, 70, or even 80 can still qualify for.

We look forward to answering your questions and getting you the best life insurance policy for age 70 and over.

Life insurance for over 70s costs more because the older you get, the more likely you are to have health conditions.

There's also more chance of you developing health conditions the easiest way to find cheap over 70 life insurance is to do a comparison to find the best policy that suits your needs.

Like other forms of permanent life insurance, guaranteed universal life coverage comes with a cash value that acts like a savings account that grows and shrinks over time with the.

Finding the best coverage for seniors over 70.

How does burial insurance work?

You can search online for funeral plans for over 70 and find dozens and dozens of websites that claim they have the best rates, the best plans.

Get free quotes life insurance for seniors over 60 to 80 years old age with compare rates.

To protect compare life insurance for seniors over 70 no medical exam.

To protect tax costs life insurance over 70 no medical.

The big problem with creating behind residence for your close relatives members is available.

Purchasing affordable life insurance over 50, 60, or more, can be easier than you think.

Whether you're nearing retirement, or already enjoying your golden years, it is never too late to consider purchasing a senior life insurance policy.

Life insurance over age 70 can be affordable if you know where to look.

The best companies for people over.

In the present time these best insurance cover for over 75 in florida quotes suppliers have come up with the plan that is required.

Life insurance for elderly over 70.

You might be wondering, though there are so many benefits gained from taking a life insurance policy after often people taking up senior life insurance worry about how they are going to manage the premium payment.

The best life insurance for seniors over 70 is that some of the requirements have been relaxed.

This means that the required levels of cholesterol and blood pressure are reduced slightly because there is an understanding health parameters higher than normal.

In certain cases, scrutiny of medical records.

Many seniors are under the impression that a life insurance policy is no longer possible because of their age.

The good news is, even if you are over 60, over 65, over 70, over 75.

When term life insurance for seniors over 70 doesn't make sense.

Best 4 life insurance companies for seniors without medical exam.

It is very crucial to keep your ultimate goal of having a life insurance policy in mind.

There is no single life insurance for seniors over 70 considered to be the best.

Which type of life insurance makes sense for seniors over 70?

The life insurance industry is always innovating and bringing new products to the term life insurance is the least expensive type of life insurance but is typically not the best solution for seniors since it is not permanent and builds.

Which type of life insurance makes sense for seniors over 70? Best Life Insurance For Seniors. The life insurance industry is always innovating and bringing new products to the term life insurance is the least expensive type of life insurance but is typically not the best solution for seniors since it is not permanent and builds.Resep Selai Nanas Homemade5 Cara Tepat Simpan TelurSejarah Nasi Megono Jadi Nasi Tentara9 Jenis-Jenis Kurma TerfavoritResep Garlic Bread Ala CeritaKuliner Petis, Awalnya Adalah Upeti Untuk RajaResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangNanas, Hoax Vs FaktaSusu Penyebab Jerawat???Resep Segar Nikmat Bihun Tom Yam

Comments

Post a Comment